income tax malaysia 2019 due date

Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts. Income that is attributable to a place of business as defined in Malaysia is also deemed derived from Malaysia.

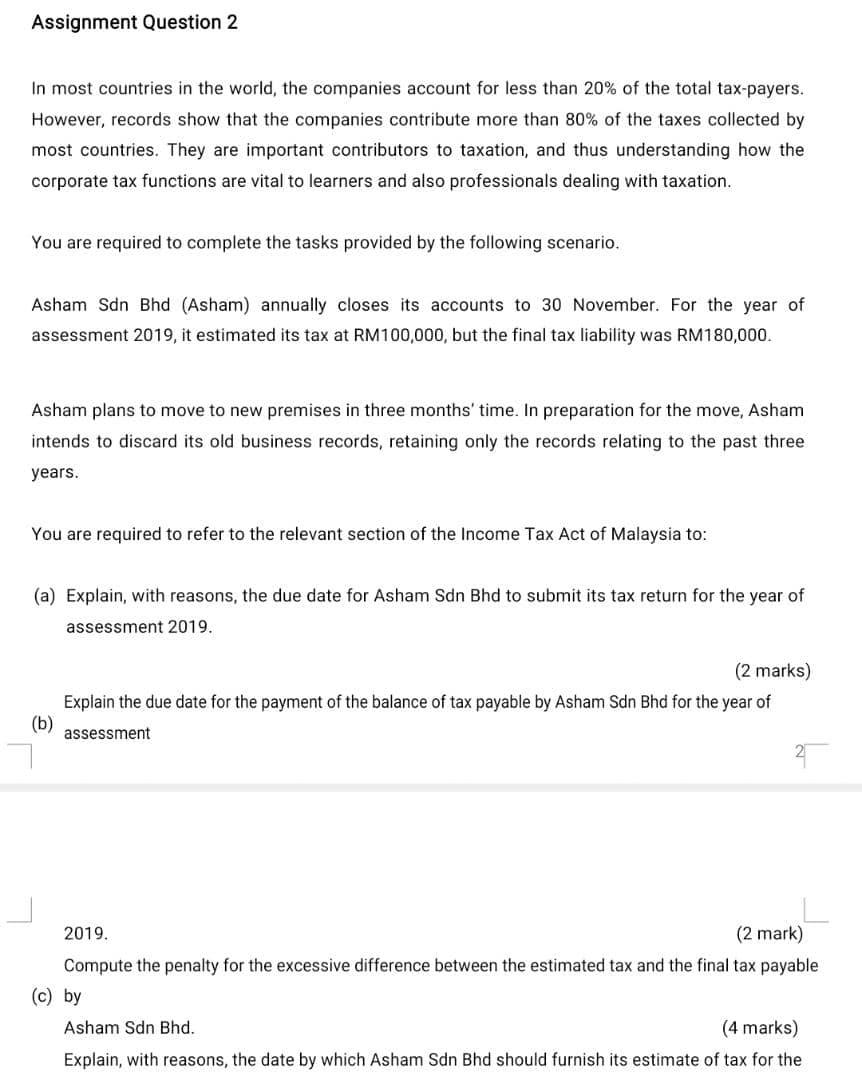

Assignment Question 2 In Most Countries In The World Chegg Com

Under normal circumstances tax payments are due on or about April 15.

. A qualified person defined who is a knowledge worker residing in. The tax return is submitted not later than 30 April without business income and 30 June with business income in the following calendar year. 10 December 2019 Page 1 of 42 1.

The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. PIT return due date. On the First 20000.

The new deadline for filing income tax returns in Malaysia is now 30 June 2020 for resident individuals who do not carry on a business and 30 August 2020 for resident. Objective The objective of this Public Ruling PR is to explain - a special classes of income. On the First 5000.

30 April without business income and 30 June with business income PIT final payment due date. Business income B Form on or before 30 th June. - Two 2 months grace period from the due date of submission is allowed for those with accounting period ending 31 July 2019 until 31 August 2019.

31 July 2019 until 31 August 2019 ree 3 months grace period from the due date of submission is allowed for those with accounting period ending 1 September 2019 until 31 December 2019. With effect from Wef 1 January 2022 income derived from outside. Employment income e-BE on or before 15 th May.

Other entities Submission of income tax return Deceased persons estate Association. Within 5 years after the end of the year the exemption relief remission allowance or deduction is approved. Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors.

You can file your taxes on ezHASiL on the Inland Revenue Board of. - Three 3 months grace period. By 30 April without business income or 30 June with business income in the year following.

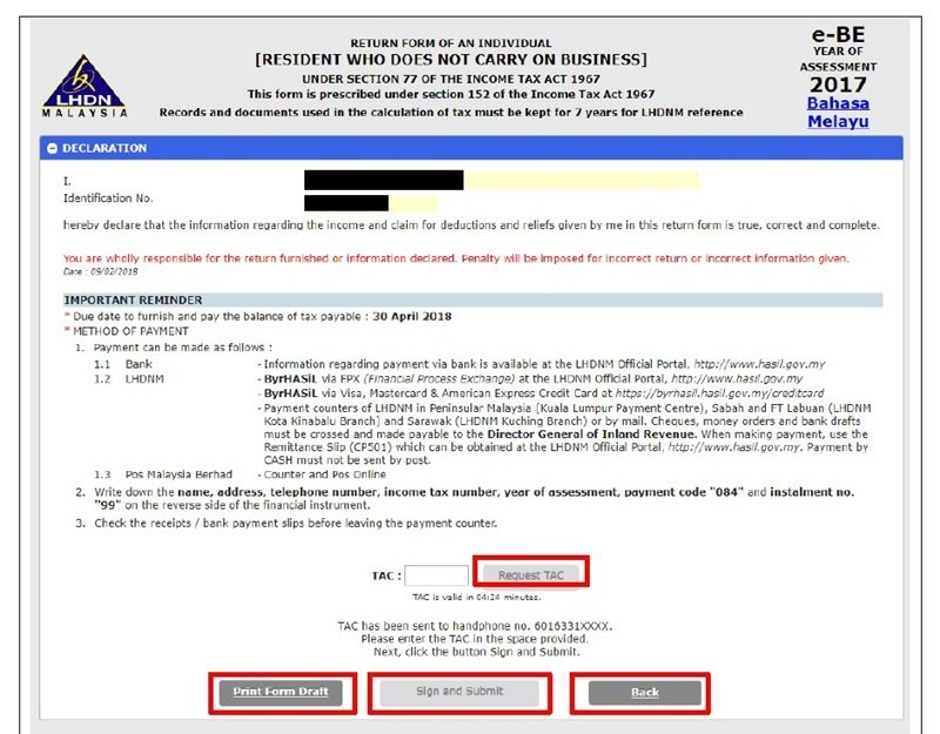

On the First 5000 Next 15000. Calculations RM Rate TaxRM A. The deadline for filing income tax in Malaysia is April 30 2019 for manual filing and May 15 2019 via e-Filing.

Tax deduction not claimed in respect of expenditure incurred that is subject to. In line with the announcement by Prime Minister Tan Sri Muhyiddin Yassin of Malaysia on the implementation of the Movement Control Order MCO 1 to limit the outbreak. 30 April without business income and 30 June with.

E-filing or online filing of tax. INLAND REVENUE BOARD OF MALAYSIA Date of Publication. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Employment income BE Form on or before 30 th April. The Tax tables below include the tax. You normally must pay by that date if you havent had sufficient tax withheld from your paychecks.

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

How Much Does The Federal Government Spend On Health Care Tax Policy Center

How To Fix A Mistake In Your E Filing For Malaysians By Juinn Tan Medium

Grant Thornton Johor Reminder Extension Of Various Tax Deadlines Filing With The Inland Revenue Board Of Malaysia Two Months Extension Is Given For Filing Of Remuneration Return For Employers For

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Market Profile Hktdc Research

Malaysia Personal Income Tax Guide 2020 Ya 2019

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

Individual Income Tax In Malaysia For Expatriates

Cch Axcess Workstream Accounting Workflow Software Wolters Kluwer

Individual Income Taxes Urban Institute

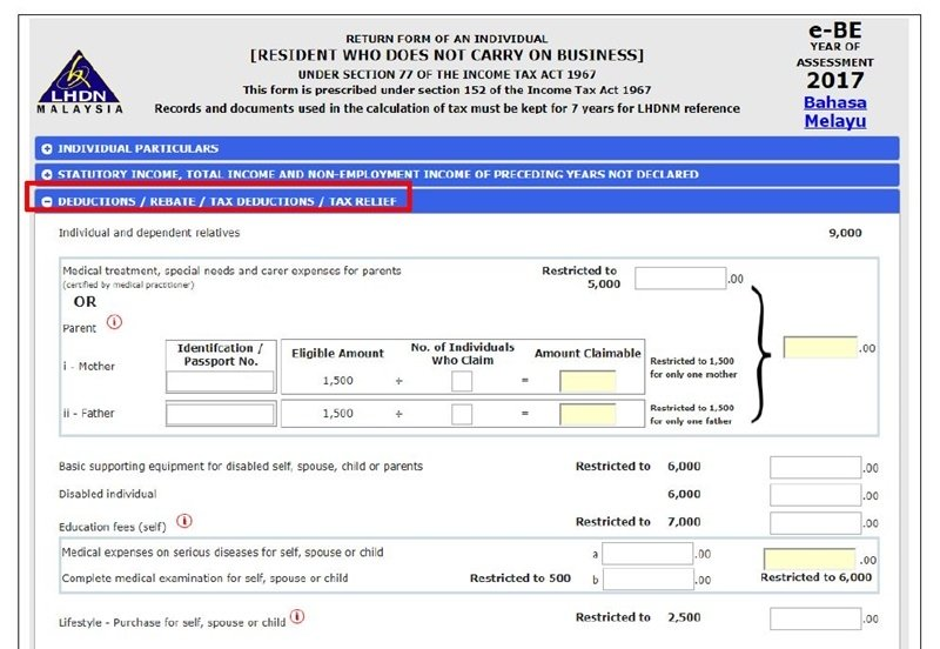

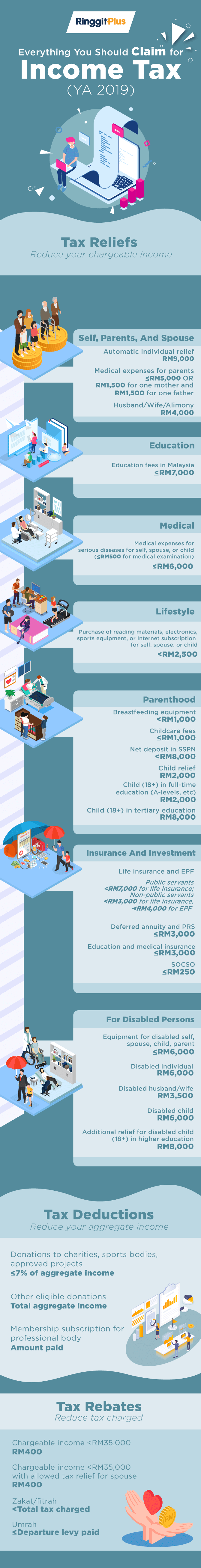

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

10 Things To Know For Filing Income Tax In 2019 Mypf My

Kshoo Advisory 𝗧𝗮𝘅 𝗥𝗲𝘁𝘂𝗿𝗻 𝗙𝗶𝗹𝗶𝗻𝗴 𝗗𝘂𝗲 𝗗𝗮𝘁𝗲𝘀 𝗡𝗲𝘄 𝗨𝗽𝗱𝗮𝘁𝗲 Facebook

Personal Income Tax E Filing For First Timers In Malaysia

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Comments

Post a Comment